The substantial amount of $70 million liquidated in XRP and DOGE futures could be interpreted as an indication of heightened speculative activity in major markets. This is because an enormous quantity of money was liquidated.

Since the amount of money that was liquidated was not typical, this is the case. You must be aware that the price of Bitcoin dropped below $100,000 in the late hours of the United States time zone, and then it made a tiny recovery in the early hours of the Asian time zone on Thursday. This occurred after the Federal Reserve suggested that it would cut interest rates in 2025, which led to the idea being made in the first place.

Value of XRP, DOGE, and SOL:

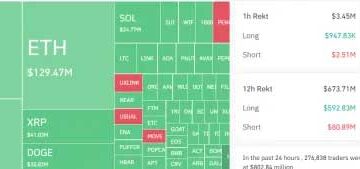

The value of XRP, DOGE, and SOL all had a decline of up to 5.5%, while the value of BNB Chain’s and ETH experienced a decrease of 2.5%. Because of the decline in the value of bitcoin (BTC), futures contracts that track major tokens experienced liquidations that totalled more than 700 million dollars. This was a consequence of the decline in the value of bitcoin . The losses that were sustained by products involving XRP and dogecoin (DOGE) were significantly greater than the average size of losses.

Following a decline that occurred in the late hours of the United States: Bitcoin (BTC) had a minor comeback during the early hours of Thursday morning in Asia. This came after the price of Bitcoin had fallen below $100,000. This occurred after the Federal Reserve suggested that it would cut interest rates in 2025, which led to the idea being made in the first place.

- In response to a question regarding the strategic reserve promises made by President-elect Donald Trump, Federal Reserve Chair Jerome Powell stated, during a news conference that took place after the meeting of the Federal Open Market Committee, that the central bank was not permitted to buy bitcoin under the regulations that are currently in place. This statement was made in response to a question that was posed to him.

- Powell, the Secretary of State , indicated that although that is the kind of thing that Congress needs to take into consideration, we are not pushing for a change in the legislation. Powell made this statement. This statement was made by Trump during a campaign in July, and it was about the stockpile of banned Bitcoin that the United States of America is now keeping. While he is in power, the government will keep one hundred percent of all the bitcoin that it currently holds or acquires in the future. He also stated that this would be the case.

Direct consequence of Powell’s statements:

As a direct consequence of Powell’s statements, the value of Bitcoin dropped by three percent, which in turn caused major markets to experience a loss as well. The value of XRP, dogecoin (DOGE), and Solana’s SOL all experienced a decline of up to 5.5% over this time. The value of BNB Chain’s BNB and ether (ETH) , on the other hand, both experienced a decline of 2.5% compared to the previous day.

- In terms of performance, the token that did the poorest was Chainlink’s LINK token, which had a decrease of 10%. As a direct consequence of this, a portion of the gains that had been made earlier in the week were considered to be void. This transpired as a result of World Liberty Financial, which is supported by Trump, purchasing tokens for a total of two million dollars.

- The numbers reveal that around 700 million dollars worth of bullish bets were liquidated as a result of the collapse in the market. This was the result of the market’s collapse. The futures contracts that track lesser altcoins and meme tokens sustained losses that were significantly higher than those experienced by futures contracts for Bitcoin or Ethereum . This is a really rare occurrence.

- It is quite probable that large-scale liquidations are an indication that market extremes, such as panic buying or selling, are taking place at present. It would appear that a price reversal is likely to occur shortly as a consequence of an overreaction in market sentiment. There is a possibility that a series of liquidations could be an indication of a turning point in the market, which would demonstrate that a price reversal could be on the horizon.

- The view that Powell’s remark may signal a local top has been expressed by traders. This has the effect of lowering expectations of a further climb toward the end of April due to the fact that it has the ability to signify a local peak. Traders have expressed their conviction that Powell’s statement may imply a local top.

Nick Ruck, who is the director of LVRG Research, stated that ” Crypto markets may have entered a peak if U.S. Bitcoin’s strategic reserve is no longer in play.” The rally that took place over the preceding several months, which finally resulted in new all-time highs, was fueled by this certainty, which served as the incentive for the rally.

Federal Reserve Chair Jerome Powell Waring:

After Federal Reserve Chair Jerome Powell gave a warning that inflation will continue to be a problem during the coming year, the market responded with a significant reaction. This occurred immediately after Powell’s statement. A decline in interest rates would ordinarily have a bullish reaction since it was greatly expected; yet, this is the result that has occurred. This is the case even though this consequence has occurred.

On the other hand, traders at QCP Capital, which has its headquarters in Singapore, continue to maintain a perspective that is cautiously optimistic over the upcoming year. Not only should you not permit yourself to be thrown out of your natural position if there is a drop, but you should also avoid doing so.

Conclusion :

Given that 2025 is anticipated to be a potentially lucrative year for Bitcoin , particularly with Trump in power, the organization asserted in a broadcast message that was sent out on Thursday that continuing with business as usual may prove to be helpful. This assertion was made because Trump is in authority. This comment was made because it is anticipated that the year 2025 will be a good year for cryptocurrency .

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply