Key Insights

- Donald Trump emerged victorious in the 5 November U.S. presidential election.

- As a result, his pro-crypto policies have become a significant topic of discussion in the Crypto space.

- Some significant benefits of having Donald Trump in office include a less stringent approach to Crypto regulation and a generally friendlier environment for investors.

- The true extent of the benefits (or detriments) remains to be seen over the next four years.

Donald Trump is preparing to take office as the 47th President of the United States on 20 January 2025.

The implications of such a significant change for the Crypto industry, as expected, are drawing widespread attention.

Bitcoin’s recent break above the $100,000 milestone is creating much optimism about how the Trump administration’s policies might affect the future of Crypto in general.

Here are all the possible changes that might arise and their impact on the crypto market as a whole.

The World Will Embrace Crypto More

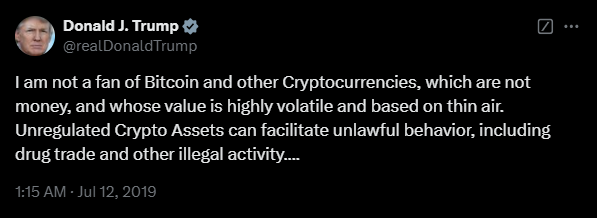

Interestingly, Donald Trump dismissed Crypto as a “scam” during his first term.

He warned that cryptocurrencies undermined the dominance of the U.S. dollar and were based on “thin air.”

However, his perspective has changed dramatically over the last year, as U.S. voters can attest.

Throughout his re-election campaign, Trump embraced cryptocurrencies and promised to make the United States “the Crypto capital of the planet.”

He even launched his own crypto venture, World Liberty Financial, which has attracted considerable investment so far.

Donald Trump’s U-Turn on Crypto aligns with the increasing mainstream acceptance of digital assets.

The demand for spot Bitcoin and Ethereum ETFs has also skyrocketed, showing that investors increasingly recognize Crypto as a legitimate investment class.

The U.S. (and the rest of the world) is expected to become more friendly towards Crypto.

Crypto Regulation Should Lighten Up

One of Trump’s most notable moves was the nomination of Paul Atkins (a pro-business Republican and former SEC commissioner) as the new chair of the SEC.

Atkins is a known supporter of innovation and a lighter regulatory approach.

He has also previously stated that regulations should not burden investors or stifle market growth.

These sentiments have set the stage for Atkins so far, positioning him as an SEC chair who might support a welcoming environment for crypto.

Atkins’ approach is also vastly different from the harsh policies the Crypto industry endured under former SEC Chair Gary Gensler.

According to the Blockchain Association, the SEC (under Gensler’s leadership) has filed over 100 enforcement actions against major Crypto players like Coinbase and Ripple between 2020 and 2024.

If confirmed as pro-crypto, the Crypto industry expects Atkins to steer the SEC towards clearer guidelines.

The new chair is also expected to balance innovation with consumer protection.

At the same time, the regulatory changes that the Crypto industry needs will require time, and patience remains a virtue.

More Crypto-Friendly Officials

Bitcoin’s recent surge above the $100,000 mark shows growing market confidence in a crypto-friendly administration.

Investors are becoming more optimistic that the new policies will encourage innovation and attract more participation from institutions.

The altcoin and memecoin markets have seen significant gains due to this optimism.

All of the above, therefore, signals a bullish outlook for the Crypto market under Trump.

The optimism is even more prominent with Trump’s appointment of Crypto advocate David Sacks as the “AI and Crypto Czar.”

The new administration intends to create a more supportive regulatory framework for new and even experimental sectors.

Competition Among Countries Should Skyrocket

As the U.S. moves toward its “crypto capital of the world” ambitions, other countries are unlikely to sit idly by.

Countries like China (which has already launched its own digital Yuan ), the European Union (with its digital euro project) and many others will likely put in more effort to lead the digital currency revolution.

These developments between world superpowers could spark a global race for crypto dominance.

Countries like Japan, Singapore, and South Korea are already recognized as crypto-friendly hubs.

Many of these already have advanced regulatory frameworks that encourage blockchain development.

However, if the Trump administration introduces a more favorable environment for the sector as promised, the U.S. could outpace these competitors.

These geopolitical tensions under Trump could push Bitcoin’s demand upwards, especially as a hedge against fiat instability.

Prices will inevitably rise if all of this happens.

The Proposal for a Strategic Bitcoin Reserve

Another one of Trump’s ambitious ideas is the creation of a strategic Bitcoin reserve in the U.S.

This reserve is similar to the country’s strategic oil reserve and could be a major tool for stabilizing Bitcoin’s value.

It could also be great for providing a safety net for investors during economic uncertainty.

So far, critics have argued that cryptocurrencies lack the intrinsic value of commodities like oil.

However, proponents like Republican senator Cynthia Lummis see this as a bold step toward legitimizing Bitcoin as a financial asset.

In an interview with PBS, Brian Blank, a finance professor at Mississippi State University, said that such a reserve could reduce Bitcoin’s volatility.

By holding large amounts of the cryptocurrency, the U.S. federal government could instill confidence in the market and even help to stabilize prices.

Looking Ahead

The Trump administration’s pro-crypto stance shows a significant shift in U.S. Crypto policy.

By fostering a supportive environment, the U.S. government could create an environment with a broader adoption of cryptocurrencies and decentralized technologies.

At the same time, there are a few challenges relating to consumer protection and the risks of crypto volatility.

So far, Trump’s goal of making the U.S. a global leader in Crypto innovation could be a major driver of increased investment.

Blockchain technology applications will begin to spread across industries, from healthcare to supply chain management.

The world is watching closely, and the next four years could be pivotal for Bitcoin and the Crypto ecosystem as a whole.

Disclaimer: This article is aimed at delivering accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply