Key Insights

- Memecoins are unlike regular cryptocurrencies in that they have no inherent use cases.

- However, they have played a massive role in the market’s dynamics since their popularization in 2020.

- Memecoins are great drivers of market liquidity and have ushered many investors into Crypto.

- While many of them turn out to be scams, the ones that survive have significant potential to become legitimate projects as the market evolves.

Meme coins were once dismissed as a passing fad—nothing to be concerned about—even a scam.

However, this asset class has since evolved into a major force in the Crypto market.

Despite their origins, this class of cryptocurrencies often has a major impact on investor sentiment and even market trends.

In this article, we go over how memecoins like Dogecoin and Shiba Inu have influenced the Crypto ecosystem.

We will also examine their broader implications and possible future in the Crypto space.

What Are Meme Coins?

Meme coins are cryptocurrencies, no different from others like Bitcoin and Ethereum at bottom.

The only difference is that they are mostly inspired by internet memes or popular culture references.

They are unlike utility tokens because they do not serve a specific function within the blockchain ecosystem.

Instead, they start out as jokes or social experiments and eventually become forces to be reckoned with.

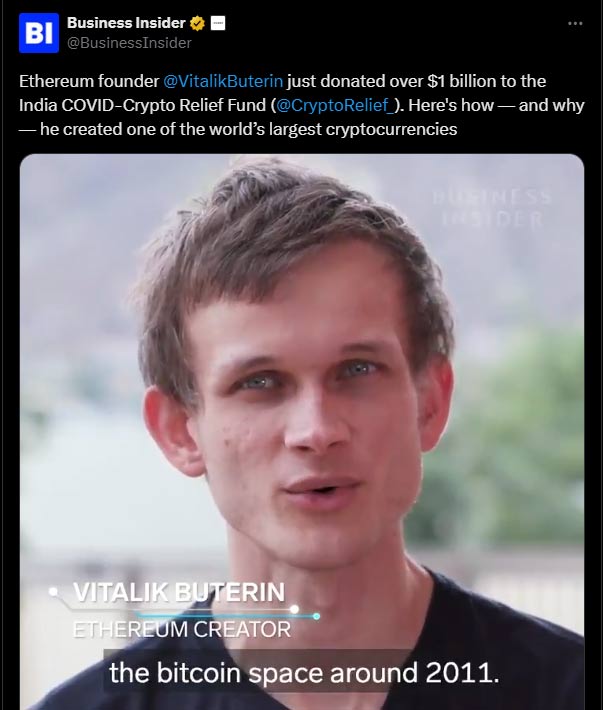

They can also gain virality from factors like strong community marketing and even direct or indirect endorsements from high-profile individuals, such as Elon Musk with Dogecoin and Vitalik Buterin with Shiba Inu.

Key Characteristics of Meme Coins

Memecoins are different from other kinds of cryptocurrencies because they are mostly community-driven.

This means that they rely heavily on their communities for growth.

Enthusiasts in any memecoin project often create buzz through social media platforms. Members of the public then take it up from there and invest heavily.

Another major factor with memecoins is their Low Entry Barrier, where most memecoins are priced cheaply.

This makes them especially attractive to retail investors looking for high returns on investment.

The prices of this asset class are also highly volatile and can skyrocket overnight.

However, they are equally prone to sharp declines and are a great but risky investment.

How Meme Coins Have Driven Market Changes

Unlike other cryptocurrencies, which require a use case for relevance, memecoins drive up the general market’s popularity via pop culture appeal.

They tap into the Internet’s love for humor and trends like Dogecoin and can even be used to contribute to real-world use cases.

A good example is the 2021 donation from Ethereum Founder Vitalik Buterin of $1 billion in Shiba Inu tokens to CryptoRelief, an India-focused COVID-19 relief fund.

Endorsements from influential figures like Elon Musk have also propelled memecoins to new heights, with the Crypto market becoming bright green or red from a single tweet alone.

As a result of this speculatory nature, many investors are drawn by the cryptocurrency’s potential for explosive returns despite the involved risks.

Stories of early adopters turning small investments into millions have added to the allure of this asset class over the years.

How Memecoins Affect The Market

Memecoins are often overlooked. However, they are likely one of the biggest drivers of investor interest in Crypto.

Their simplicity and all the above factors make them an appealing entry point for beginners.

The high trading volumes this asset class garners are also a major contributor to overall market liquidity.

Their activity often benefits exchanges and traders by increasing transaction volumes.

Memecoins also spur innovation by funding new blockchain projects, with a good example being Shiba Inu’s Shibarium.

As of writing, the Shiba Inu ecosystem now includes an Ethereum L2 solution Shibarium), staking mechanisms, lending protocols, and so much more.

The Issues With memecoins

Some of the major problems with memecoin come as a result of their “scam to success” ratios.

The rapid price increases often seen in memecoins usually create speculative bubbles.

These bubbles eventually burst, causing massive financial losses for latecomers.

Their lack of utility also means that they do not solve real-world problems and, therefore, only have value as long as they are discussed on the Internet.

Due to their low market caps and concentrated ownership, memecoins are even highly prone to market manipulation and rug pulls.

The popularity of memecoin creation tools like Pump.fun has exacerbated this problem by making it extremely easy for anyone to launch a memecoin with only a few button clicks and a few dollars worth of $SOL.

How Memecoins Have Affected Regulation

Memecoins have gained immense popularity over the years, and have expectedly raised questions regarding regulation.

Many governments and financial institutions have taken notice of this highly speculative asset class over the last five years, and are seeking new ways to protect retail investors—especially with how notorious it has become when it comes to scams.

As of 2024, the memecoin market is currently in a gray area.

This is because while some jurisdictions have established regulatory frameworks for crypto in general, memecoins often fall outside the scope of these guidelines.

As a result, their lack of inherent utility or defined use cases has caused many investors great financial losses alongside gains.

Going forward, the memecoin market is expected to become more monitored with guidelines that further improve their legitimacy.

While the memecoin market is on its way to becoming more regulated, the risk of over-regulation remains active and could stifle innovation in the general crypto market.

Future Outlook for Meme Coins

The future of meme coins In the Crypto market might be uncertain. However, it is also undeniably a bright one.

Their success depends on sustained community engagement and regulatory development, which is something the Crypto industry is full of.

While many memecoins will inevitably fade into obscurity, others could evolve into legitimate projects in the future.

Disclaimer: This article is aimed at delivering accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Leave a Reply