Key Insights

- The spot Bitcoin ETF market was established in the US on 11 January 2024.

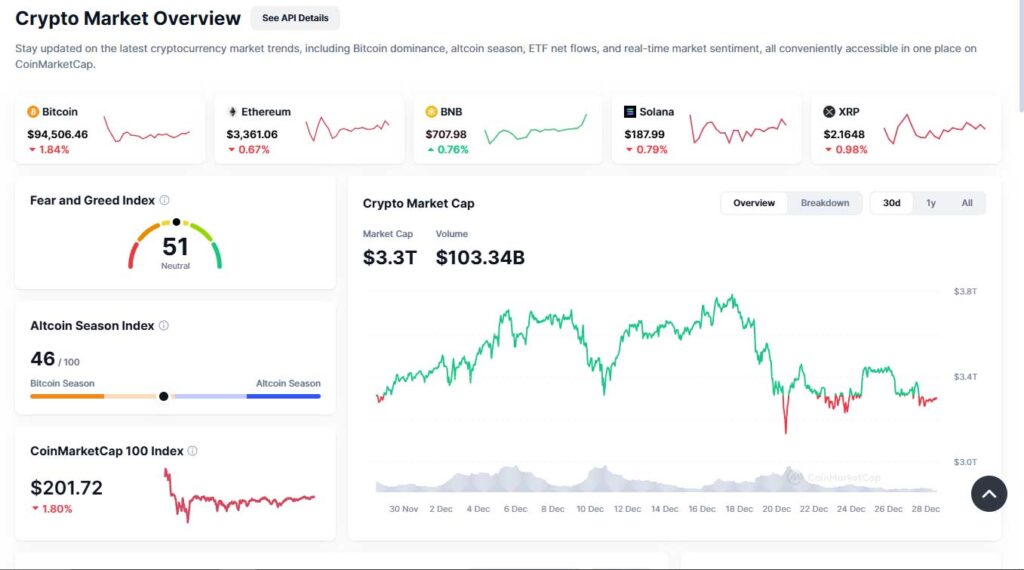

- This market has expanded and now has billions in AUM and trading volumes.

- Spot Bitcoin ETFs continue to take in more Bitcoin than miners can produce, creating a supply shock that could help prices.

- The Bitcoin ETF market was also directly responsible for Bitcoin’s initial crossing of the $50,000 mark in January.

- So far, analysts expect a more favorable future for Bitcoin and fewer violent price swings.

The Crypto market witnessed a historic milestone on 10 January 2024, when the US Securities and Exchange Commission approved the first 11 spot Bitcoin ETFs.

This approval marked a new chapter for Bitcoin and provided investors with a regulated but accessible way to gain exposure to the world’s leading cryptocurrency.

The ETFs began trading the very next day, creating ripples across the financial and Crypto sectors that are still spreading to date.

What Are Spot Bitcoin ETFs?

Spot Bitcoin ETFs are a kind of exchange-traded product, much like stocks or bonds.

The only difference is that they hold actual Bitcoin in secure digital vaults.

This change distinguishes them from the futures-based ETFs that mimic Bitcoin’s price movements.

This also distinguishes them from regular Bitcoin assets in that it allows investors to gain exposure without directly owning the cryptocurrency.

With the spot Bitcoin ETFs, investors could also benefit directly from Bitcoin’s price appreciation without having to manage digital wallets or private keys.

Market Implications of Spot Bitcoin ETFs

The introduction of spot Bitcoin ETFs has had massive effects on the Crypto and financial markets in 2024.

For example, this new asset class in the US contributed significantly to liquidity in the Bitcoin market.

It also significantly contributed to Bitcoin’s initial crossover above the $50,000 zone between January and March.

These funds have attracted retail and institutional investors and have made buying and selling Bitcoin easier.

The enhanced liquidity also supports better price stability and efficient price discovery.

Another major factor in this ETF introduction is greater institutional involvement in the Crypto market.

Large-scale investors have begun to view cryptocurrency as a legitimate asset class and are choosing to invest in it because of its regulated nature.

Shifting Market Dynamics

The influx of institutional capital has also changed the market’s dynamics.

For example, the spot ETF market has absorbed more Bitcoin than miners can produce.

Put simply, this dynamic has created a “supply shock,” driving up prices and increasing competition among investors.

For example, data from Soso Value shows that the spot Bitcoin ETF market has raked in a cumulative total net inflow of $35 billion since launch, with an impressive $3 billion traded as of December 2024.

While this institutional investment lends credibility to Bitcoin, it also introduces wilder price swings.

Most of this comes from the larger volumes of buy and sell orders from these large-scale investors.

However, the overall liquidity provided by these ETFs has led to more stable prices in 2024 and even through 2025.

At the same time, the launch of these products has attracted more regulatory scrutiny. Lately, authorities have been monitoring issues such as market manipulation and custodial risks a lot more closely.

Broader Market Impact

In terms of broader impact, the market cap of Bitcoin has grown substantially.

This shows a higher level of investor interest and confidence in the cryptocurrency. The cryptocurrency’s dominance has risen so far, with a solid position above the $2 trillion mark.

Retail Investor Challenges

However, the effect of this “supply” shock is that as the ETFs continue to consume more of the cryptocurrency’s supply, retail investors might find it more challenging to buy.

This supply/demand imbalance could affect Bitcoin’s accessibility for smaller investors, and drive them further towards the altcoin market.

Through it all, the spot Bitcoin ETF market has shown strong performance, with AUM spikes and significant trading volumes on the daily timeframe.

These metrics, which are booming, only show the high demand for these investment vehicles and their growing role in the financial landscape.

What Challenges Could Be On The Way?

While spot Bitcoin ETFs offer many advantages, they also come with challenges, including price volatility, regulatory changes, and possible tracking errors between the ETF’s performance and Bitcoin’s actual price movements.

Still, introducing these products has been a game-changer for the Crypto market.

They offer a regulated way to invest in the market and will likely continue to enhance market liquidity by attracting investors on all sides.

As the market continues to change, the spot Bitcoin ETFs will play more and more of a role in shaping the future of crypto investment.

Looking Ahead

While the spot ETF market in the U.S. is doing well in terms of adoption, other countries are likely to jump on the bandwagon.

Places like Europe, Canada and even parts of Asia will begin to establish their own spot Bitcoin ETFs and broaden asset to this asset class.

This increase in adoption is bound to be highly beneficial to Bitcoin’s liquidity in the long run.

Institutional participation will also grow as well, with more corporations recognizing the cryptocurrency’s position as an asset with asymmetric risk.

More financial products linked to Bitcoin will inevitably spring up over the next decade, including actively managed ETFs and derivatives.

In the end, the spot Bitcoin ETF market will likely integrate more features like real-time settlement and tokenized shares.

Moreover, partnerships between ETF providers and blockchain startups will result in a boom for new asset custody technology.

In the midst of this boom, investors should be mindful of liquidity crunches by putting diversified investment strategies and robust risk management frameworks in place.

Disclaimer: This article aims to deliver accurate and up-to-date information but will not be responsible for any missing facts or inaccurate information. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply