As expected, the Fed dropped rates by 25 basis points.

Guys You Must Be Aware About The Following :

- The Federal Reserve has decreased the benchmark fed funds rate by 25 basis points, bringing it down to a range that is now between 4.25% and 4.50%.

- The “dot-plot” predicts that the Federal Reserve will decrease interest rates to 3.9% in the following year, so it can be deduced that the Fed will make fewer reductions than it predicted in September. In addition, the Federal Reserve raised its forecast for the PCE inflation rate in 2025 to 2.5%, according to the projections.

- “The projected slower path of further rate cuts reflects hotter inflation readings in previous months and higher inflation expectations,” said Jerome Powell, the chair of the Federal Reserve. “The slower path of further rate cuts is correlated with higher inflation expectations.”

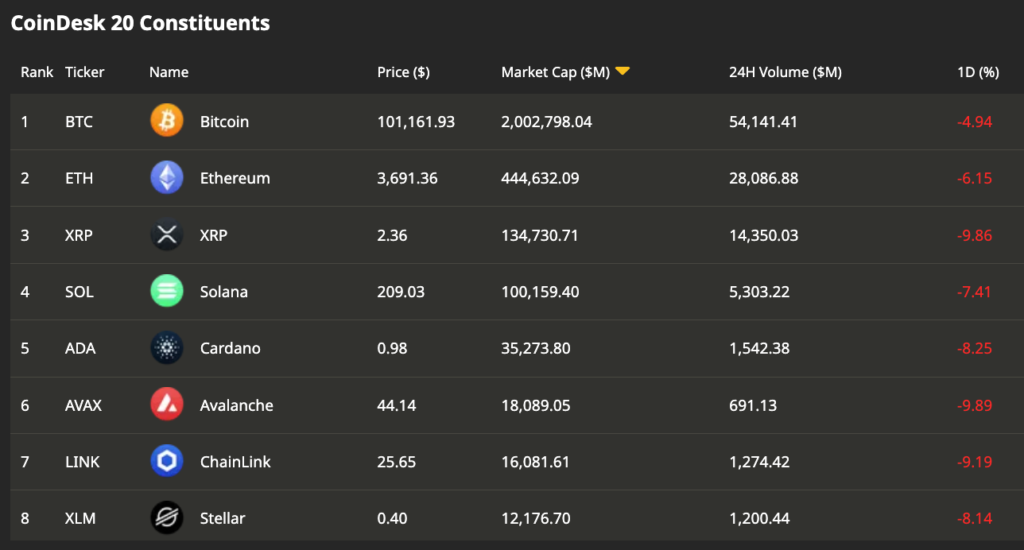

- Over the last twenty-four hours, Bitcoin’s price fell to $101,000, representing a reduction of nearly 5%. In addition, the prices of the major alternative cryptocurrencies XRP, Cardano’s ADA, and Litecoin’s LTC all fell by approximately 10%.

- There was a reduction of 25 basis points in the benchmark fed funds rate that was implemented by the Federal Reserve of the United States, bringing it down to a range of 4.25%-4.50%.

- A total of one hundred basis points of interest rate reductions have been implemented by the Federal Reserve of the United States since September. This is the third consecutive move that the Fed has taken to soften monetary policy this year.

- Even though market participants had expected the decision that the central bank would make on Wednesday, recent statistics had shown that the economy was continuing to grow at a healthy clip and that inflation was on the increase.

- As a consequence of this, the focus of attention today is being put on the policy statement, the most recent economic estimates, and the press conference that is scheduled to take place with Chairman Jerome Powell. All of these things are believed to provide clues about the Federal Reserve’s thinking toward future policy measures.

The Federal Reserve’s Quarterly Economic Projections:

Which include the “dot plot” that indicates where the central bank anticipates the Federal Funds Rate to fall over time, suggest that policymakers anticipate the Fed Funds Rate to decrease to 3.9% by the end of the year 2025, an additional 50 basis points in rate reduction in the following year.

- This is based on the fact that the “dot plot” indicates where the central bank anticipates the Federal Funds Rate to fall over time. This figure is greater than the 3.4% that was anticipated in September, it can be deduced that the monetary policy in 2025 will be less supportive of the economy.

- From September’s prediction of 2.1% and 2.2%, respectively, members of the Federal Reserve anticipated that both personal consumption expenditures (PCE) and core PCE inflation would grow to 2.5% for the following year. This represents an increase from the previous forecast of 2.1% and 2.2%, respectively.

As A Result Of This News:

The price of bitcoin (BTC) fell from roughly $104,000 to approximately $101,000 at the time that Fed Chair Jerome Powell addressed the press. This represents a decrease of almost five percent during the period of the twenty-four hours that have just passed.

- At the beginning of the session, the price of bitcoin (BTC ) had already dropped to a lower level. Even more significant falls were seen in smaller cryptocurrencies, such as Litecoin’s LTC, Cardano’s ADA, and XRP, all of which saw decreased rates of approximately 10%. A session low was also reached by the S&P 500 index on Wednesday, which resulted in the index dropping to new depths.

- During the press conference that followed the FOMC decision, Fed Chair Jerome Powell stated that the slower pace of further rate decreases is a consequence of hotter inflation readings in previous months and higher inflation expectations for the next year. He said this in response to the fact that the FOMC decision was delayed at the time. After the decision was announced by the Federal Open Market Committee (FOMC), Powell issued this statement as a response.

- At the end of his remarks, Powell stated, “We are closer to the neutral rate, which is another reason for further moves.”

- Powell responded to a question from a reporter about the possibility of the government establishing a strategic bitcoin reserve during the presidency of Donald Trump by stating that the Federal Reserve is “not allowed to own bitcoin” according to the Federal Reserve Act and that the Fed does not intend to modify the law concerning this matter. Powell’s statement was made in response to the question.

European Head of Research at Bitwise:

He says that “I think the biggest headache for the Fed right now is the fact that financial conditions have still tightened despite the Fed cutting rates.” This statement was made before the activity that took place today.

This declaration was made before the action that was carried out in the current day. “Long bond yields and mortgage rates have increased since September and the dollar has appreciated which also implies a tightening in financial conditions.”

Dragosch, “A continued appreciation of the US dollar also poses a macro risk for bitcoin because dollar appreciation is associated with global money supply contraction as well, which tends to be bad for bitcoin and other crypto assets ,” he explained further. “Bitcoin appreciates in tandem with the global money supply contraction.”

In actuality, the Federal Reserve’s net liquidity is continuing to decrease with each passing day. The combination of a strong currency and a tightening of liquidity is, in my opinion, the most important challenge Bitcoin faces.

Conclusion :

On-chain signs for Bitcoin continue to be highly promising, particularly the consistent fall in exchange balances, which gives weight to the hypothesis that the Bitcoin supply scarcity is continuing to get more severe. Despite this, other data for Bitcoin continue to be quite positive.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply