Is Ethereum Ready to Soar to New Heights in Q1 2025? Analysts Forecast Record Prices

Analysts say that Ethereum may be ready for a significant price surge, as it could soon beat its previous all-time high by the first quarter of 2025. Though Bitcoin just hit a record $100,000 on December 6, Ethereum has not been able to sustain its lead over the psychological threshold of $4,000. However, market dynamics show that there is a change in momentum, and this might be a boon for Ethereum in the near future.

What’s Fueling the Optimism for Ethereum?

The most recent market report from Bybit and Block Scholes revealed a heavy deleveraging in the crypto market. Analysts interpret this deleveraging as the reset of the leveraged long positions, creating a good chance for price increase. As per the Bybit analysts, “We expect a new all-time high in Q1 2025,” adding that Ethereum is already showing strength in the derivatives market, with traders expecting a strong price catch-up.

Factors Contribute to Ether’s Momentum

US Inflation Data Bolsters Ethereum Price

Ethereum’s price continued its momentum following the release of positive inflation data. The Consumer Price Index for November came in at 0.3%, marking four consecutive months of positive growth. The core CPI, which excludes food and energy, also rose 0.3%, thus in line with estimates. After this report, traders increased their bets that the Federal Reserve would announce an interest rate cut. This pushed up market demand for riskier assets like Ether.

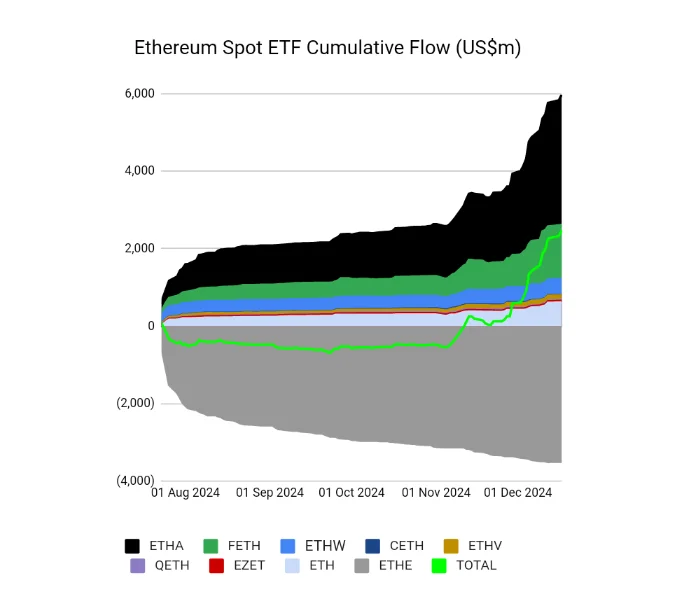

Ethereum Spot ETFs See Record Inflows

Ethereum ETFs in the U.S. have attracted consistent capital inflows since November 21, bringing their combined assets under management to $1.98 billion by December 12.

This record-high capital inflow highlights increased interest from both institutional and retail investors.

Trump’s Crypto Project Acquires Ethereum

Donald Trump’s DeFi project, the World Liberty Financial Initiative (WLFI) purchased $10 million in Ethereum. According to Lookonchain, a firm which provides blockchain analytics, WLFI purchased 2,631 ETH at an average price per token of $3,801.

These purchases contributed towards the growing crypto assets, whose value now exceeds over $74.7M held by WLFI, hence pushing market confidence in Ethereum.

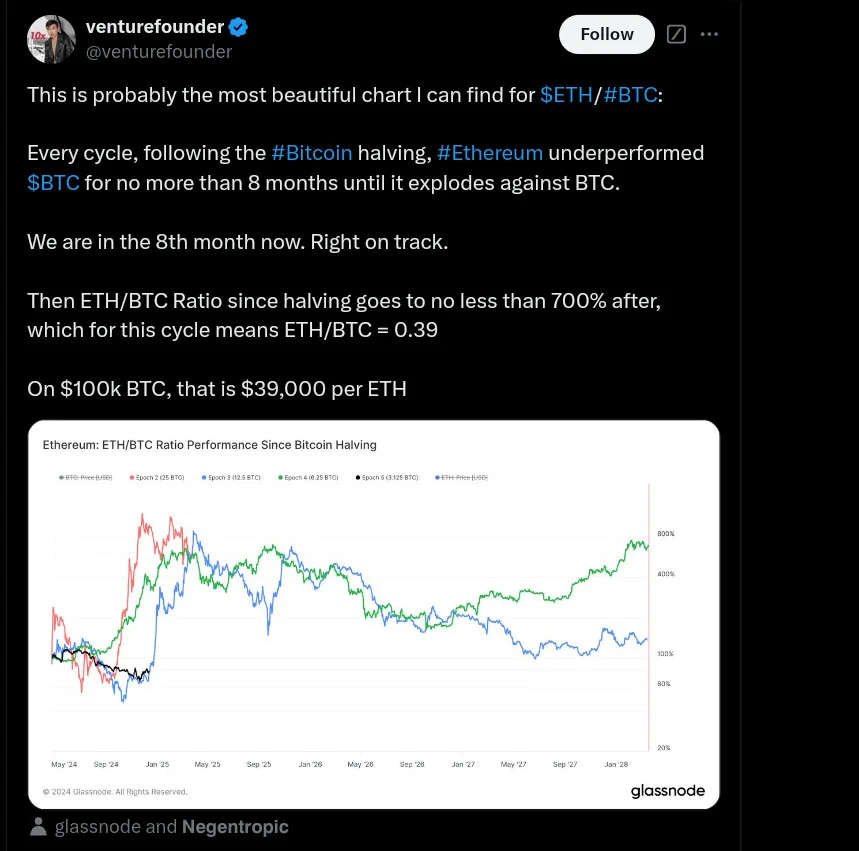

The Upcoming Bitcoin Halving

Ethereum’s performance follows the halving cycles of Bitcoin. In the past, Ethereum trails Bitcoin by approximately eight months before experiencing significant growth. According to Venture Founder, a crypto analyst, “We are in the 8th month now. Right on track.” The ETH/BTC ratio could surge significantly if this trend continues.

Can Ether Break $5,000? The Role of Regulation and Staking

Ethereum (ETH) could soon hit $5,000, according to blockchain analytics firm CryptoQuant. This is based on the price band analysis it used, which relies on historical trading patterns to forecast price boundaries. The “upper band” of this analysis currently puts Ethereum’s possible top at $5,200, near its 2021 bull market high.

How Regulation Could Affect Ethereum Price

The regulation aspect is not left behind in the growth of Ethereum. Due to Donald Trump, who is to take office in January 2025, there will be great changes in the policies about cryptocurrency in the U.S. This has been confirmed by Trump, being a pro-crypto himself. He is associated with WLFI, which is a DeFi project, indicating he has a good attitude toward crypto.

A likely change to look forward to would be the resignation of the existing SEC Chair, Gary Gensler. Gensler has been criticized by the crypto community for being overly hostile towards cryptocurrencies. Many people feel that such a position prevents innovation from occurring in this space.

President Trump has nominated former SEC commissioner Paul Atkins for the job. Atkins has a crypto-friendly approach and previously argued for balanced regulation as a way of promoting growth in the blockchain space.

Once finalized, the Atkins rule could ease regulatory pressure and enhance further clarity for crypto projects in attracting institutional investments. When a more positive regulatory scenario prevails, more cryptic financial products are going to be approved, among which would be additional Ether-based exchange-traded funds, hence creating more demands.

Institutional interest in Ethereum has increased dramatically. Last week, Ethereum ETFs received $1.2 billion inflows worldwide, showing a growing confidence among large investors. These ETFs create a regulated route for institutions to invest in Ethereum, making it more accessible and attractive.

Another feature is the mechanism of Ethereum staking. Since Ethereum adopted proof-of-stake, they have, in the past locked up their tokens for staking rewards. This reduces supply and gives upward pressure in terms of price. Therefore, it needs more people to join and stake their own investments.

Ethereum’s Underperformance May Be Temporary

Ethereum has outperformed its rival Bitcoin in the year 2024. Performance-wise, Bitcoin returns stand at 150% within six months. Contrarily, Ethereum managed only a 53% return.

In terms of technical analysts, however, more is in sight for Ethereum’s future performance. One technical analyst with username “Long Investor” said if this breakout can surpass $4,100 resistance levels, then it is on the track to retake the previous record at $4,865. And if it gets sustained, Ethereum may even climb to $8,800.

Impact of Bitcoin’s Halving Cycle on Ethereum

Ethereum’s performance often correlates with Bitcoin’s halving cycle. Historically, Ethereum lags behind Bitcoin for approximately eight months post-halving before surging in value. Crypto strategist Venture Founder said, “Every cycle, following the Bitcoin halving, Ethereum underperformed BTC for no more than 8 months until it exploded against BTC.”

The market is now 8 months post-halving, and some expect for that one-time point, Ethereum will start doing things better than Bitcoin. ETH/BTC ratio may push up to 0.39, which means in comparison to Bitcoin, Ethereum gains 700% or more, compared to previous cycles.

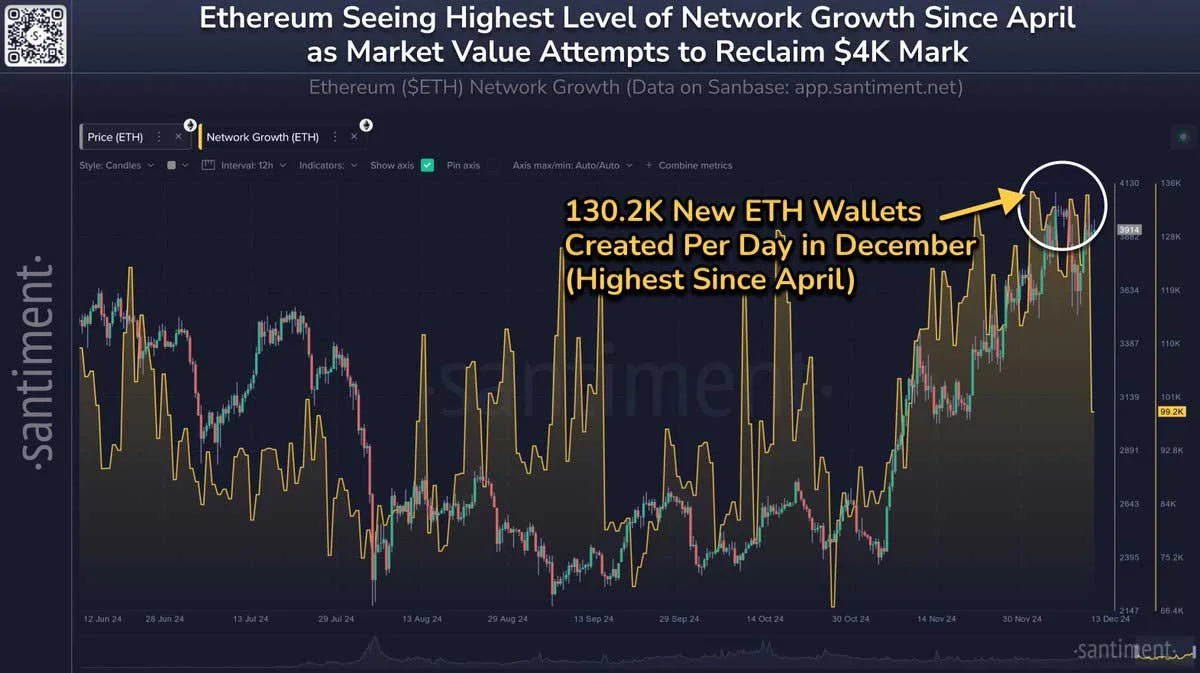

Rising Number Of Investors Interested in Wallet Activity

Investor interest in Ethereum is growing, which can be seen in the creation of new Ethereum wallets. Santiment data shows that more than 130,000 new wallets were created daily in December, the highest number in over eight months.

While many analysts are optimistic about Ethereum, some are less sanguine in their expectations. Asset manager VanEck, for instance, thinks that Ethereum may touch $6,000 in 2025 while Bitcoin reaches $180,000. Tempered expectations from some quarters imply that though Ethereum will certainly grow well, it would still be lagging behind Bitcoin in percentage terms.

Does This Mean For ETH-Based Coins Shiba Inu and Yeti Ouro?

Ethereum may be able to achieve a new all-time high in Q1 2025, and its effect on tokens built on its network is massive, including the likes of Shiba Inu and Yeti Ouro. After all, these tokens operate completely on Ethereum’s network, relying on its transactions and smart contracts; therefore, any improvement to the performance of Ethereum will reflect on their ecosystems.

For Shiba Inu, the growth in Ethereum will make it go faster and more scalable. With improvements such as the Ethereum 2.0 where Ethereum is made faster and easier, the same will apply for Shiba Inu that its transactions will be sped up and cheaper. Finally, a bullish Ethereum will be the same for SHIB since, most the time, the price of SHIB follows the price of Ethereum.

But, on the flip side, Shiba Inu comes with a plethora of challenges-including its vast token supply at 589 trillion that has rendered significant jumps in price almost impossible. Given that Shiba Inu already boasts an exceptionally active community, and with new developments- such as Shibarium-being implemented to improve its use, much adoption and further innovation will need to emerge for it to maintain that momentum.

However, Yeti Ouro is, in reality, a growing star in the Ethereum environment. It hosts the popularly surging racing Play-to-Earn game built on Unreal Engine known as Yeti Go. As compared to Shiba Inu, Yeti Ouro features a burn mechanism that burns a percentage of its transaction fees. This is what makes its supply decline over time and creates scarcity, which will make its value rise. Yeti Ouro is also differentiated by a focus on gaming and staking rewards, appealing to both gamers and investors. So far, the token has generated significant interest, raised $1.2 million in the presale, and is on the rise as Ethereum tests new highs.

Whereas Shiba Inu already sits very firmly on a well-established position on the crypto, yet has strong fundamentals and all grounds for taking advantage of still a rising Play-to-Earn. They may both enjoy tailwind as Ethereum continues its run higher; however, growth into them will depend on getting as many users as they possibly can and remaining on peoples’ radars in this area.

ETH-Based Tokens Going Forward: Conclusion

With the recent push to a new all-time high in Q1 2025, Ethereum may be setting a new course for the future of ETH-based tokens like Shiba Inu and Yeti Ouro. With such a large community and developments like Shibarium, Shiba Inu is destined to continue enjoying the benefits of improved scalability and speed. However, the gigantic supply of its tokens might cap the potential for it to experience high price growth without mass adoption or utility improvement.

As much as Yeti Ouro features uniqueness and focuses on the play-to-earn gaming sector, which sits strategically to gain long-term wins, sustainability of growth is also covered since the burn mechanism is built in for its staking rewards in order to keep growing as well as how it interrelates into the field of gaming, opening an avenue for user expansion. This kind of setup makes Yeti Ouro an attractive investment towards the opportunities tied to wins upon the success of Ethereum.

As Ethereum continues to boom, so will the tokens built on its network. Shiba Inu is bound to benefit from what this network will build out; however, innovative in their approach and probable possibility of high returns makes one of the picks for 2025 Yeti Ouro. As if Ethereum’s surge brings explosive growth to the same tokens, it is only time that tells, but the momentum it builds up for a transforming year ahead.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply