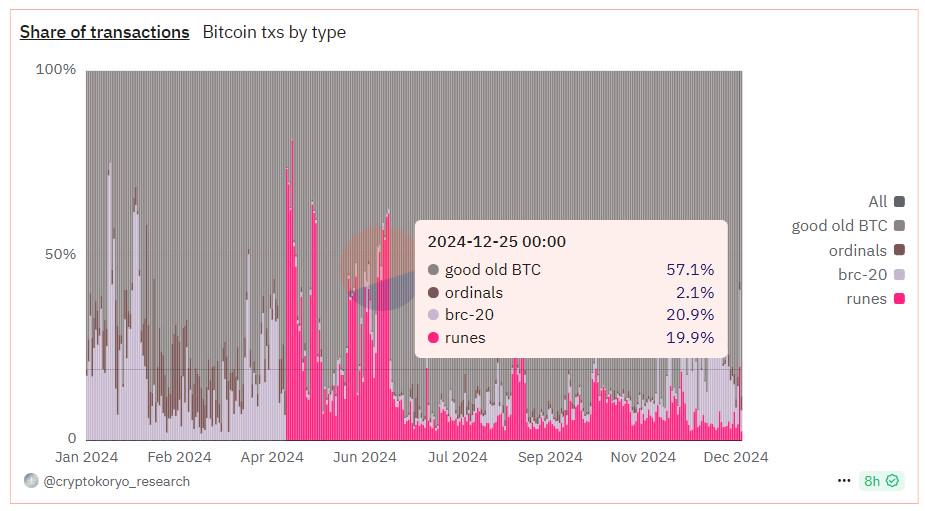

By the time the year 2024 comes to an end, Bitcoin Runes will have completely and utterly lost all of their impetus. On April 23, the Bitcoin Runes protocol recorded more than 750,000 transactions. This was the highest number ever recorded.

The number of daily transactions reached an all-time high with this particular statistic. By the end of December, the system will have completed 100,000 transactions; however, there are now a great deal of difficulties that are preventing it from doing so. In the entire month of December, this pattern stayed unchanged for the entire month.

During the month of December:

There was a significant drop in the total number of transactions that were carried out on the Bitcoin network using the Runes protocol. This decrease was observed in this particular month. A decrease of this magnitude took place throughout the course of the month.

It is important to note that the highs that were reached throughout the more significant months of 2024 were significantly lower than this decline, which represents a significant fall. This reduction is indicative of a significant decrease.

Since the Runes protocol was initially released:

It has constantly had the highest bandwidth on the Bitcoin network. This has been the case ever since. This is something that has been the case ever since it was initially put into effect. Since the very beginning, this has been the circumstance that has been occurring.

- Runes had more than 753,000 transactions as of the 23rd of April, surpassing the Ordinals protocol, BRC-20s, and Bitcoin BTC, which had a total worth of $95,571 at that time. Runes also became the most valuable cryptocurrency in the world.

- In comparison to every one of these other cryptocurrencies, Runes performed significantly better. This record is accountable for accounting for around 81 percent of all transactions that take place on the Bitcoin blockchain. It is responsible for accounting for these transactions. The scope of this includes not only monetary transactions but also transactions that are not monetary.

The momentum that runes had been experiencing remained until the beginning of May:

However, it started to decrease once more in the middle of the month. Throughout May, Runes had been experiencing a surge of momentum. As an additional point of interest, the protocol experienced a substantial increase in the overall number of transactions that were carried out throughout the entirety of June.

The protocol had a difficult time maintaining people’s interest, and by the end of the month, it had lost more than 88 percent of the audience that it had the potential to attract.

Fifteen million transactions:

More than fifteen million transactions were registered by Runes throughout the first four months of the year. Runes was the one responsible for registering these transactions. Additionally, during the month of July, the Runes protocol witnessed a dramatic decline in the level of popularity that it enjoyed.

- The fact that the percentage of transactions that are based on the Bitcoin protocol has decreased to less than nine percent on average is an indication that investor interest in non-fungible tokens (NFTs) based on Bitcoin has decreased.

- This is because the percentage of transactions that occur on the Bitcoin protocol has decreased. One might infer from this that the Bitcoin protocol has experienced a decline in popularity.

- It was able to record more than 15 million transactions in its first four months of being active, which is evidence that the protocol could continue working for a period that was significantly longer than that. This was demonstrated by the fact that it was able to do so. At the end of August, the protocol had surpassed 15.6 million NFT transactions. This was the highest number of transactions ever recorded.

Following the completion of these transactions, fees totalling more than 160 million dollars were incurred. As an additional point of interest, the protocol saw a brief revival throughout the month, with a total of 255,000 transactions being reported on August 23. This day marked the beginning of the protocol’s implementation for the first time. It was at this very moment that the protocol was written down permanently for future reference.

The month of September:

However, the number of transactions that were carried out using the Runes protocol decreased once more in the month of September, and it was difficult for it to recover to its previous highs over the last quarter of the year 2024. This was the case throughout the entire year. This phenomenon persisted throughout the entirety of the year.

Consequently, this indicates that Runes reported a transaction share for Bitcoin that was lower than 10% throughout the month of December:

- The percentage of Bitcoin transactions carried out using Runes continued to fall throughout December, indicating that this trend will continue. Runes are a form of cryptocurrency. Except for Christmas Day, when it had a 19.9% percentage of Bitcoin transactions, the protocol had a transaction share that was lower than 10% throughout the remainder of the month. This was the only exception. During the remaining days of the month, the protocol was able to attain a transaction share that was lower than ten percent.

Why has Bitcoin Runes also decreased?

The broad decrease in interest in non-fungible tokens (NFTs), the popularity of Bitcoin Runes has also decreased. This is because of the widespread reduction in interest in NFTs. This decline could have been caused by various factors, as may be the case.

- The value of non-fungible tokens (NFTs) saw a decrease that lasted for seven months in the year 2024. This decline also occurred in the year 2024.

- After that, there was a slight recovery in the months of November and December of that same year, which followed the decline that had occurred before. For the first time since 2021, the monthly sales volumes for digital collectables dropped below $300 million during the month of September.

Conclusion:

This phenomenon occurred for the first time. The occurrence of this particular drop was the first time it happened. It had never happened before, and this was the very first time it had ever happened. NFTs had experienced yet another all-time low at this moment, which was the point at which they had reached since the beginning of the year. This was the point at which they had reached.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply