MetaMask, a prominent self-custodial wallet that specialises in cryptocurrencies, has launched a crypto debit card for the United States. This will allow users to spend their cryptocurrency on everyday purchases and, thus, make blockchain-based assets more easily integratable into real life.

It was initially launched in a small pilot program and will be one of the most ground breaking ways for users to interact with cryptocurrencies in everyday life.

It connects the digital and physical worlds. The card automatically converts cryptocurrency to fiat money for payments. It addresses long-standing challenges, such as high transaction fees, security risks, and limited usability of crypto assets.

What is MetaMask Card?

The MetaMask Card can be considered a crypto debit card where one can shop using his or her held cryptocurrencies with the MetaMask wallet. Users can use it at any place, either through a shop or online service that offers Mastercard services. What this basically means is the use of digital assets that are utilized just like a common debit card.

The most significant feature of the MetaMask Card is its real-time conversion mechanism. Once the user pays, it automatically converts the required amount of cryptocurrency into local fiat currency and there is no manual conversion needed as it directly gives a hassle-free experience in transactions.

Key features of MetaMask Card

Real-Time Conversion: The MetaMask Card is designed with user convenience, security, and flexibility. Amongst other things, it’s amazing at how it can function flawlessly at any place that accepts Mastercard- whether in a physical store or an online merchant-very useful for everyday transactions.

- Integration with Digital Wallets: It supports integration with digital wallets like Apple Pay and Google Pay. Then it lets people link the MetaMask Card to popular digital wallets, so payments are instant without even requiring a MetaMask Card.

- Secure and Private: Security is always the first priority for MetaMask Card. Unlike banks, where the funds are always stored with third parties, this card will ensure the user’s control over their cryptocurrency, as funds will remain in the self-custodial MetaMask wallet until the moment of transaction, providing that layer of security that decreases exposure to hacks and thefts.

- Spending limits: This product also allows users to limit the amount they can spend on the card, thus enabling better control over finances. These are particularly helpful in setting budgets and managing expenditure.

How to Get the MetaMask Card

The MetaMask Card is available only in the United States for now. Users interested in obtaining the card need to follow a simple registration process:

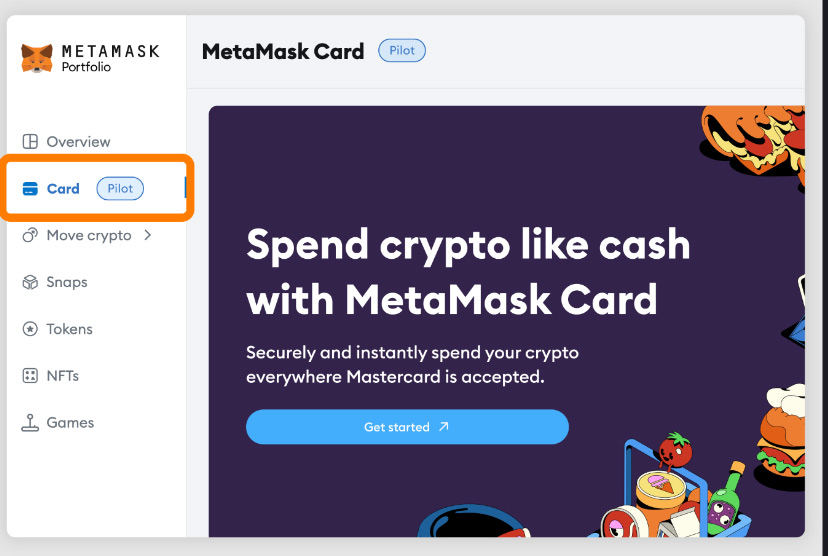

Users need to access the MetaMask Portfolio and get to the “Card” tab.

The user then creates an account with Crypto Life, which happens to be the program manager handling the MetaMask Card. It requires users to complete their identity verification to fulfill their regulatory requirements. They then have to enter an email address and a phone number during registration for setting up an account.

Once the registration process is complete, the card is now associated with the user’s MetaMask wallet. This makes the card usable, and users can now use it for making payments without much hassle and convert crypto into fiat in real-time.

It should be noted that MetaMask Card is currently unavailable for people who reside in New York and Vermont, because regulatory limitations prevent this access. Still, residents of all other states can join a waiting list and receive their access.

Supported Cryptocurrencies and Networks

The MetaMask Card has currently supported three major currencies: USDC, that is, USD Coin, USDT, or Tether, and wETH – Wrapped Ethereum. All those assets are based on the Linea network, that is to say, the blockchain infrastructure developed by MetaMask. Thus, all transactions are fast, reliable, and cost-effective.

The MetaMask Card supports widely-used cryptocurrencies, which appeals to a wide variety of users, from experienced crypto investors to those who are new to digital currencies. Stablecoins such as USDC and USDT provide a more stable spending option since their value is pegged to fiat currencies.

How the MetaMask Card Overcomes Major Challenges

The largest problem facing the adoption of cryptocurrency has been that of being able to spend digital assets in the real world. The MetaMask Card solves this problem by putting blockchain technology into a familiar format.

It eliminates high transaction fees usually associated with converting crypto into fiat currency by handling conversions automatically at the point of sale, thus simplifying and saving on the costs.

Secondly, MetaMask Card improves security through holding funds in a self-custodial wallet until the time of payment. Such an approach minimizes theft and hacking risks because it is users who completely control their assets.

Lastly, the card is also very convenient to use as it integrates with Apple Pay and Google Pay, thus making it easy for users to pay for goods and services. This feature does away with the barriers for real-world usability and is easier than ever to spend crypto on everyday purchases.

Availability in the US and Global Expansion

The MetaMask Card is still in the early rollout phase in the United States. While residents of New York and Vermont are not eligible to join the pilot program, other states’ users can join the waitlist to receive the card.

The MetaMask Card is already available in several regions outside the US, including the European Union, the United Kingdom, Brazil, Mexico, and Colombia. In those countries, the card works together with the fintech company Baanx Platform, which specializes in crypto payment solutions.

MetaMask announced it will be expanding availability of the card to more countries in the near future.

The Future of MetaMask Card

The MetaMask Card is an important step toward the wider adoption of cryptocurrency. By making it easier to spend digital assets for everyday needs, MetaMask is addressing some of the most pressing challenges facing the industry.

The pilot program in the US will be very helpful for MetaMask to refine the features of the card and ensure that it meets the expectations of the users. As the program expands, it has the potential to redefine how cryptocurrencies are used in commerce, bridging the gap between blockchain technology and the real world.

Why the MetaMask Card Matters

MetaMask Card is more than an option for a new mode of payment; it heralds the mainstreaming of cryptocurrencies as a financial tool. It combines blockchain security, the convenience of a regular debit card, and everything between two extremes.

The fact that it has plans for worldwide expansion and stays innovative puts MetaMask well in the frontline of ushering cryptocurrency to the majority. For a user aiming to incorporate digital assets in their daily activities, the MetaMask Card presents a safe, convenient, and practical approach.

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply