As we have seen, MicroStrategy, the biggest corporate holder of Bitcoin has just made another aggressive move into the cryptocurrencies market. MicroStrategy, the business intelligence firm, announced earlier this month that it bought 5,262 Bitcoins worth of about $ 561 million to reach total Bitcoin assets of a whopping 444,262 BTC. Such investment proves that MicroStrategy still actively leverages Bitcoin as a treasury reserve asset, which has been the company’s activity in the past few years.

In this blog post, we will look deeper at this specific acquisition, overall MicroStrategy’s approach to Bitcoin, and the ramifications of such a strategy for the cryptocurrency industry and corporate adoption of the asset.

MicroStrategy’s Bitcoin Investment Journey

The Early Days of Bitcoin Investment

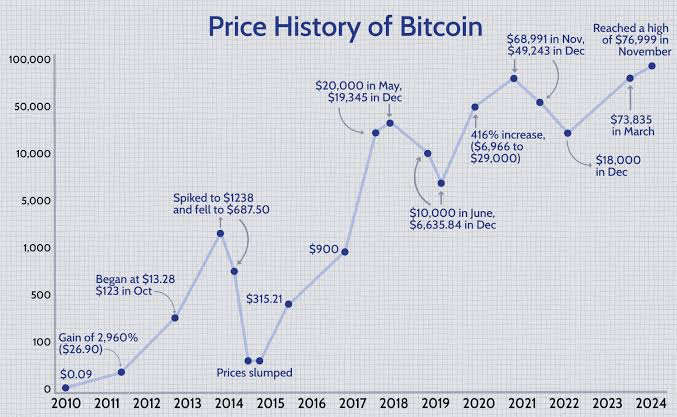

The firm took the step of entry into Bitcoin by buying its first Bitcoin in August 2020, which bought 21,454 BTC worth $250 million. In that instance, MicroStrategy’s CEO explained that Bitcoin is an attractive store of value and a hedge against inflation. Those views quickly caught up in the broader business community as MicroStrategy was the first publicly traded company embracing Bitcoin on a sizable level.

Since then, the company has expanded its Bitcoin purchases gradually, using both its operating cash flows from the primary business as well as the credit raised in the market by issuing various forms of bonds. As of 2021, MicroStrategy had acquired more than 120k BTC and became the biggest corporate BTC owner globally.

Why Bitcoin?

That is why there were several reasons that facilitated the decision to maintain Bitcoin as the treasury reserve asset. While for Saylor and MicroStrategy Bitcoin is the perfect store of value that is less sensitive to inflation and government’s monetary policies. It stated that cash and bonds for example were unattractive at the time and that is why Bitcoin was better.

Further, the decentralized nature of Bitcoin makes it a perfect hedge against geopolitical risks and uncertainties usually found with fiat currencies. The use of Bitcoin for MicroStrategy is thus a means not only of protecting its treasury but also as a step forward into leadership in the future of digital finance.

The Newest Buy: 5,262 BTC Worth $561Million

The latest purchase by MicroStrategy was 5,262 BTC for $ 561 million; the price per each Bitcoin was approximately $ 106,000. This was between the period of October and December, 2024 and the company has continued to accumulate bitcoins especially during chances that characterized the cryptocurrency market in the recent past.

This was a smart purchase at this time because it is made during a time when Bitcoin price has certain consolidating forces against it, after the uninterrupted bull run of 2023.

In the present market, the prices are an opportunity for getting more BTC for a more pleasant value. Thus, everything turns out even more in their favor as the position is formed further.

How Does This Impact MicroStrategy’s Holdings?

With this new purchase, MicroStrategy’s total Bitcoin holding stands at 444,262, making it one of the biggest holders of Bitcoin. The company is now the largest publicly traded company to hold Bitcoin and is significantly more than Tesla or Gladuey Digital.

The firm’s present stake in Bitcoin, according to current market value, is about $13 billion which is held by MicroStrategy. Still, the company shows a fierce optimism in its fundamental belief that Bitcoin will remain valuable for the long term due to its deepening entwinement with the business.

A Commitment to Long-Term Bitcoin Strategy

The former CEOs of MicroStrategy, Michael Saylor, have also freely aired their long-term outlook on the cryptocurrency. It was not just considered as a mere investment vehicle, but rather used to form the ground of the company’s long-run perspective in creating the overall value for the shareholders with active usage of Bitcoin.

The company is optimistic that the future holds for bitcoin and to raise funds from it, the company does its debt raising along with the cash flow. In an effort to raise several kinds of debts, MicroStrategy has acquired convertible notes and private offers of debt securities to meet capital forits purchase for the acquisition.

Why Corporate Bitcoin Adoption Is on the Rise

A Hedge Against Inflation and Currency Devaluation

In a world that has not kept the fears of inflation at bay, businesses need ways and means to retain their purchase power while fending off losses to fiat currency appreciation. An option presented in Bitcoin with 21 million limited coins of a decentralized nature provides much promise to what governments mint unlimited supplies in traditional fiat currency for a free spend.

It also reflects the growing feeling in corporate circles that digital assets may be a hedge against inflation and economic uncertainty. Bitcoin’s decentralized nature is an added protection against central bank policies.

Institutional Confidence in Bitcoin

One of the key drivers that has pushed the cryptocurrency into the mainstream is the institutional players entering the Bitcoin space. Companies such as MicroStrategy, Tesla, and Square (now Block) have shown that it is not just for the retail investor. Increasing interest from financial institutions, asset managers, and hedge funds further validates the position that Bitcoin occupies as a valid asset class.

This also brings about the possibility of ETFs in Bitcoin, further bringing regulatory clarity, increasing the confidence of institutions with regards to Bitcoin. Thus, more companies will begin following the lead of MicroStrategy and start placing Bitcoin in their balance sheet as part of treasury.

A Long-term Confidence Indicator for Bitcoin

This further accumulation of Bitcoin by MicroStrategy is a strong signal to the cryptocurrency market and the broader financial world that institutional investors are increasingly looking at Bitcoin as a store of value for the long term. The company’s position as the largest corporate Bitcoin holder speaks to an endorsement of the potential of Bitcoin as an asset class that can be integrated into more traditional corporate finance strategies.

Implications for the Broader Bitcoin Ecosystem

Its commitment to Bitcoin also has implications for the broader Bitcoin ecosystem. Being one of the largest holders of BTC, its buying and selling decisions can influence market sentiment. Furthermore, its involvement in the cryptocurrency space brings more attention to Bitcoin, which may encourage other corporations to consider similar strategies.

More and more companies are likely to be following the example of MicroStrategy. Therefore, the asset class is probably to be trusted even more. As a result, the potential for further adoption and innovation in the field of cryptocurrency will be encouraged, resulting in new financial products and services built on Bitcoin and other digital assets.

Conclusion: MicroStrategy’s Bitcoin Bet

The company’s purchase of the additional 5,262 BTC at a price tag of $561 million demonstrates that MicroStrategy is still optimistic about the long-term potential of Bitcoin as a treasury asset. In this regard, after making this last purchase, the company now owns 444,262 BTC, becoming the largest corporate Bitcoin holder in the world.

The integration of Bitcoin is going to be the subject matter of continued corporate adoption with time passing, and a new micro case would remain at hand about how corporate finance could get integrated along with digital assets. So, although its price remains volatile, these companies – such as MicroStrategy – are taking this bet and, as if their futures are intertwined, hope Bitcoin stays an accepted form of currency, changing finance for life to come

⚠️ Disclaimer:

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

Leave a Reply